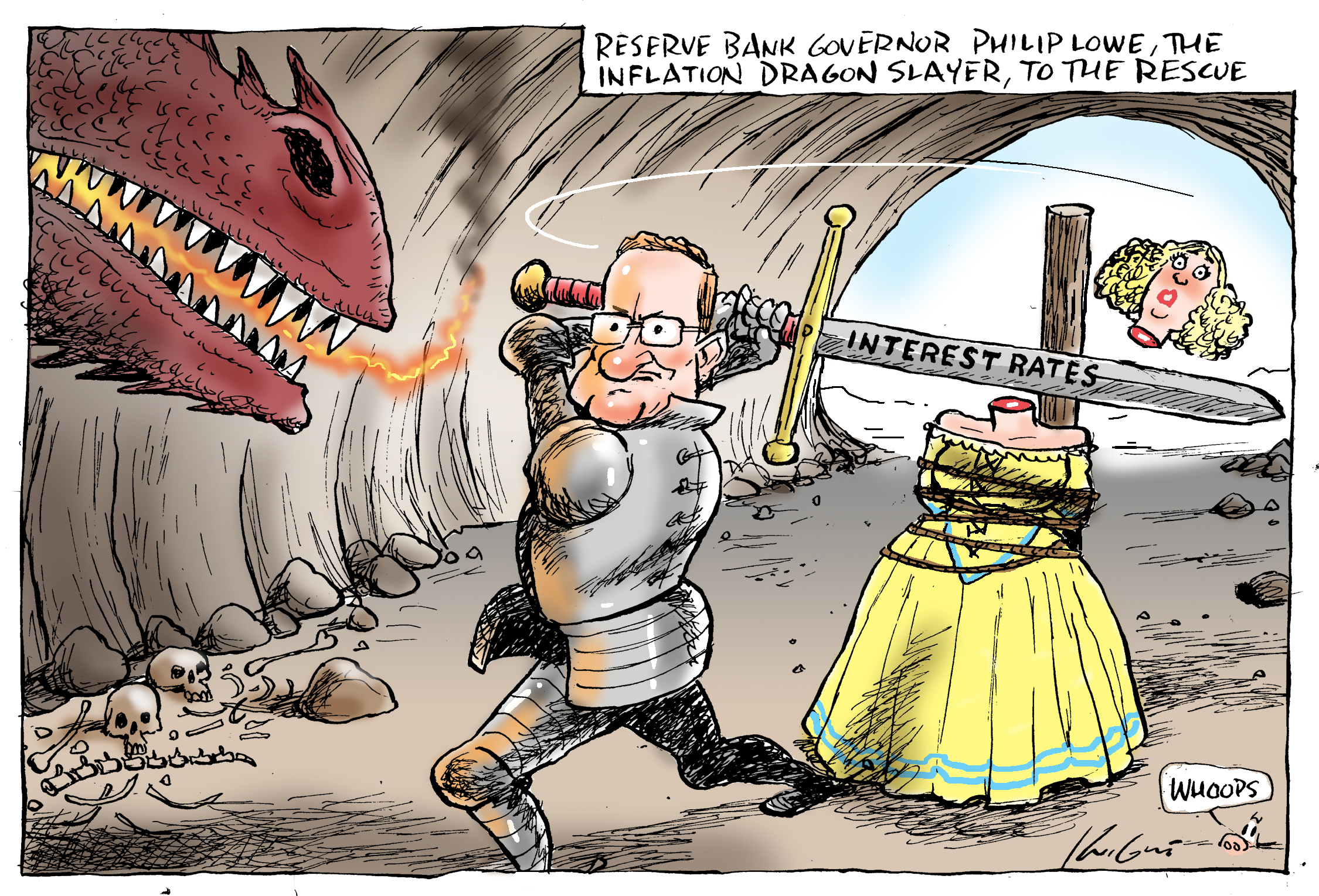

As the Reserve Bank of Australia Governor (a lovely archaic position, redolent of a bygone era of royal appointments!) Philip Lowe steps down, let’s take a moment to reflect on the interest rate shuffling game that the RBA has overseen for decades, as it now valiantly and single-handedly ‘fights inflation’ by hiking rates to quash demand, like a latter day St George slaying the dragon.

Well, I reckon our Guv’ is more like Don Quixote jousting with windmills. I only mention the person involved as he’s constantly the public face of the RBA and carries all the media opprobrium attached to each official interest rate adjustment. That such a mechanical process can be called ‘monetary policy’ is laughable, when all they do is check out a plethora of economic data and then have a stab at the most modest interest rate rise they think they can inflict on a rightly sceptical public. And then do it again, and again, until the dragon starts to look tired. ‘Lag effects’ in the economy mean that we can’t see the results for months at least, and then can’t be sure of cause and effect as other variables impact too.

The arms-length sub-contracting of this crucial role by the Federal government to an ‘independent’ authority may seem like a good idea to take political considerations out of those rate adjustment decisions. But in practice over several decades, it has become what my colleague Ross Gittins (SMH Economics Editor) calls a ‘one-trick-pony’.

Unbeknownst to one another, Ross and I each completed a Bachelor of Commerce in the golden early 1970s, respectively at the University of Newcastle and UNSW. Ross obviously took his economics seriously and has had a distinguished, life long career of reading the economic runes of ever-changing theories and data, and becoming a respected commentator.

In contrast, I also majored in psychology, which allowed me to indulge in another pseudo-scientific theory and practice – like torturing rats à la Skinner, or even better, touchy-feely ‘encounter group’ therapy methods. Exposure to both these so-called social sciences left me highly sceptical about them, and a dilettantish legacy of half-baked ideas to conjure up in these ‘analytical’ outbursts.

In my daily read of economic news and commentary I’m often in agreement with Ross’s views, and particularly criticism of the Reserve Bank’s narrow remit and single blunt instrument of battering mortgage holders (MHs) to reduce demand. As he points out, they account for only a third of punters, with a third renting and another third living the post-mortgage good life. So MHs get slugged harder and do all the heavy lifting, the banks make more money by passing on less interest to savers, and the latter also get a boost to their income.

To be fair, the government has commissioned a review of the RBA, and accepted some modest reforms in its structure and oversight, but the central bank game or canker will continue much as before, albeit with its first female governor. With any political pain still deflected by the government to the ‘independent’ body.

Meantime, the Federal government is supposed to handle other macroeconomic levers known as fiscal policy, mainly through budgetary matters. And this is where Ross and I also agree that the government could be doing a lot more: for example, variations to superannuation and Medicare levies or GST rates to dampen consumer demand more effectively and fairly. But this would require political courage and imagination. Lowe himself in valedictory speeches has been finally hinting at the government lacuna. Ross explains it well, so he can have the last word today. Thank you for being so attentive and patient, and please be quiet as you file out of class.

(Many thanks to Mark Knight for giving his kind permission to use the cartoon here)

2 fine Couriers in a row. Except for toadyism and wish to retain the (true info), tea ladies and paid for in house lunches, (like pre-Joyce qantas), the nominally tenured RBA guvs are supposed to be free to call out the lack of fiscal effort, the cozy tax lurks and everything else that results in Australians busily bidding up and up the tax sheltered property market, whilst real investment for startups, patents and general good ideas and companies languishes or goes offshore. But don’t rock the boat. Especially when the cabinet audience is so very heavily the owners of multiple properties. Even a one term honest dealer rba guv, could and should imo, create an enduring ruckus around the rank laziness and self interest holding reform back. Biden’s inflation reduction act has already I read triggered $117 billion and counting in (non property speculation) climate friendly investment. Or is that not a crisis? Xx to KC